In these uncertain economic times, I can understand turning to “financial experts” for car buying advice, and arguably one of the most famous is Dave Ramsey. Unfortunately, Mr. Ramsey’s insistence on only giving advice in black and white terms can result in information that is both incorrect and unhelpful, especially when it comes to zero percent financing.

Radio station 107.1 KTSA hosts a question and answer column with Mr. Ramsey and this week’s question is why zero percent financing is a bad idea.

Dear Dave,

Could you explain why buying a new car at 0% interest isn’t a good idea?

Raina

Dear Raina,

The only way you have a chance of getting 0% interest on a new car is if you have perfect credit and pay full MSRP (manufacturer’s suggested retail price). But, if you walk onto a car lot with cash, and haggle with the salesperson a little bit, they’ll knock a bunch off the sticker price. If you can buy the car for less than the 0% interest gimmick, how is that 0%? See what I’m saying? The cash buyer pays less.

Besides, you shouldn’t even consider buying a brand new car, unless you’re debt-free and have $1 million or more in the bank. You lose a ton in value the second you drive a new car off the lot. How is that 0%? A new car also loses about 60% of its value in the first four years after you buy it. How is that 0%?

The whole 0% interest gimmick tricks a lot of unsuspecting folks into buying something they don’t need and can’t afford!

As usual Mr. Ramsey’s solid overarching advice of don’t buy something you can’t afford and/or spend more than you need to is also buffered with some blatantly incorrect and misleading information. It is true that you need good credit to qualify for the zero-percent financing, what he means by “perfect” credit I am not sure, but you don’t need an 800 FICO score to qualify. In most cases anyone that has over a 700 FICO score will get zero percent, in some cases, buyers in the high 600 FICO range may still qualify.

However, the part where he says you have to pay full MSRP (sticker price) is completely, and utterly false. You absolutely can get a discount on a car, and even a very competitive discount and get the no-interest loan. I know this because I have probably brokered over a hundred deals for clients that were at or below the delaer invoice price, and those customers still took advantage of the zero-percent financing if it was offered by the automaker. What Mr. Ramsey might be talking about is when you sacrifice rebates from the manufacturer in order to get the zero percent offer, but this is not the same as paying “full price” and often if you are giving up a rebate in lieu of no interest the math still works out better in your favor

Furthermore, the fact that a professional financial advisor is telling people to walk onto a car lot and haggle in person is not only irresponsible during this pandemic it is also incredibly foolish when it comes to knowing whether or not you are actually getting a good price. If you are haggling at a dealer on a $25,000 car and after a bunch of back and forth the dealer comes back and says “Ok $22,000 is the best we can do.” They may not be lying to you, but you have no frame of reference as to whether or not that $3,000 is the best deal possible. The only way to know that is to get multiple bids from several stores and compare the prices. The safest and most effective way to do this is from the comfort of your computer.

Which brings me to the final point that is a running theme for Mr. Ramsey, which is that no one should be buying a new car unless they are completely debt-free and have at least a million dollars or more sitting in the bank. I’ve covered before how this is incredibly useless advice for the vast majority of people, but he goes on to say that because new cars will lose 60% of their value in four years, even at zero percent a new car is going to be vastly more expensive and therefore a bad deal.

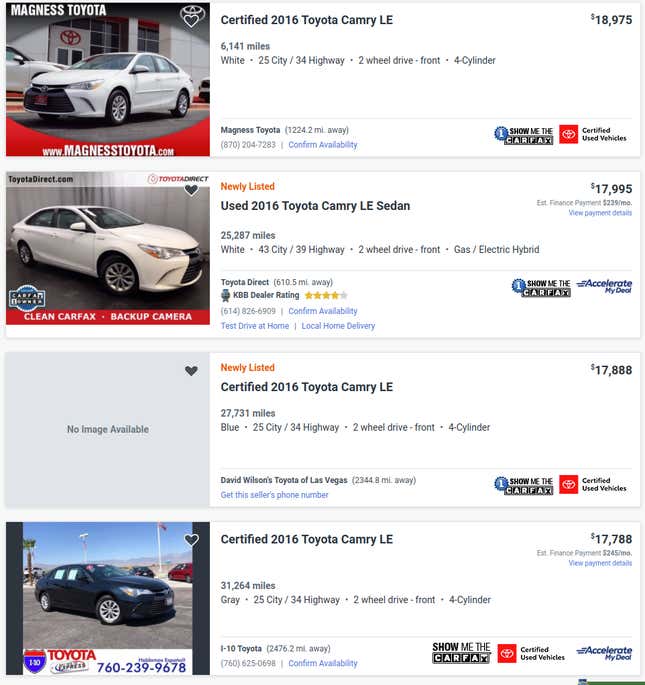

Let’s do some math. Right now Toyota is offering zero-percent financing for 60 months on all new Camrys with a starting MSRP of $24,425. Four-year-old Camry’s, with reasonable miles, despite Mr. Ramsey’s insistence, have not lost 60 percent of their value and have an average price of around $18,500.

If one were to finance $18,500 over the course of 60 months at an interest rate of five percent (which is about average for a used car) they would be looking at a payment of $349 per month.

Whereas if someone found a competitive deal on a Camry and got that $24,425 down to $22,000 and financed that car at zero percent for five years, they would have a payment of $367 per month.

Sure the new car is more expensive, but I bet people that actually have an understanding of total costs, would value that extra $18 per month for a brand new car, with a full warranty, and the latest features. I fail to see how spending an additional $18 is a “bad deal” compared to a four-year-old used car.

I understand that some folks coming to Mr. Ramsey for advice may not be financially savvy to begin with and could benefit from the never borrow or spend money mantra, but those of us in the real world should actually run the numbers before making a decision regarding financing a vehicle.